How to be Cooler

August 18, 2010 by Openyear

Filed under Sharing Economy

Last time, we broke down for you, “How to be a billionaire“. This time, we want to talk about something even more important, “How to be cooler”.

98.6 F. If you’re feeling well right now (and we hope you are), that’s very likely your body temperature. Everything has an ideal temperature range where it feels well and/or functions best. But, what is temperature anyway? It’s like a poll of molecules, that indicates the distribution of their speeds around the thermometer. Could their be an ideal pay-distribution temperature for your company or the US where it feels well and/or functions best?

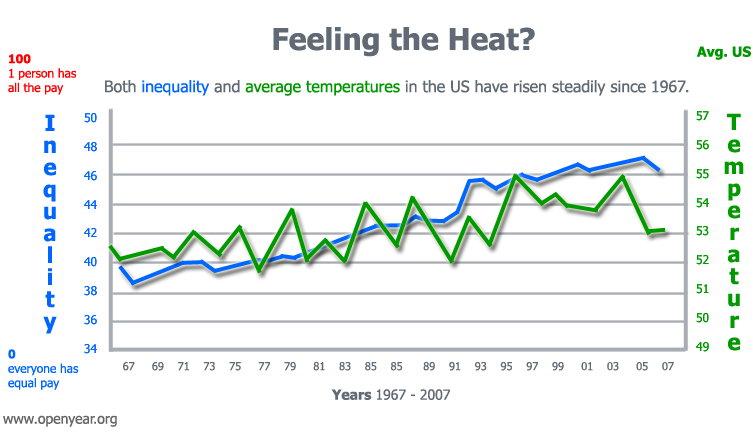

Imagine a thermometer with 100 at the top and zero at the bottom. At 100, you’re broke. One person has all the pay, and it’s not you. At 0, everyone has the same pay as you. Well right now, that thermometer in the US is set at 46 for pay, and 85 for overall wealth. Maybe you’re feeling the heat with no raise, no job, or too much debt.

Now that 2 record highs are being set for every record low, maybe you’re feeling the heat outdoors too with heat waves, weirder weather or stronger storms. If it feels like we have a fever in the US, consider that it wasn’t always so. To get the flavor how it was, let us take you back to 1968, when things were much cooler.

|

|

|

’68 wasn’t the birth of the cool. That happened in 1957. But, you could say that’s when cool hit puberty. 2001: A space Odyssey was in the theaters. Steven Spielberg called it his film generation’s “big bang”. The band Led Zeppelin formed. They’ve been ranked the third best, and one of the most influential bands of all time, by Spin. Richard Pryor, ranked #1 stand up comedian of all time by Comedy Central, released his first recording, and quiped, “When you ain’t got no money, you gotta get an attitude.” Truer words are seldom spoken.

It was easier to find cool culture, and it was easier to find a cool breeze too. Why? Because the average US temperature was 52.1 degrees, as compared to 53.1 for 2009, the second hottest year on record, which ended the 2000s, the hottest decade on record. A 1 degree rise may not sound like much until you consider that for each 1 degree Celsius we go up, crop yields drop 10%, and the area burned by wildfires in the West goes up by much larger percentages. Drought is now persistent in the West. It covers 1/3 of the Continental US, and it’s spreading. Not cool if you’re a farmer or a rancher. Not cool if you like to eat.

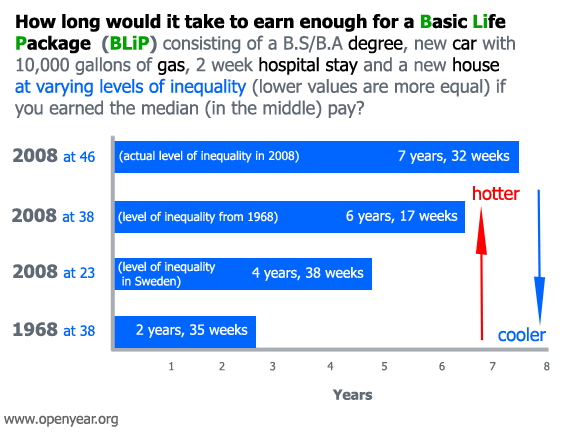

But, best of all, it was easier to find a good life, because the level of pay inequality was at a cooler 38, rather than where it is today, a hotter 46. To get a feel for what that would mean for you on a day-to-day basis, consider how long it would take you to earn enough to buy a Basic Life Package (BLiP). No one sells BLiPs yet, but we think someone should. Here’s what you’d get, 4 years of tuition towards a BS/BA degree, a new car with 10,000 gallons of gas to go with it (or equivalent electricity, if it’s a plug-in), 2 week hospital stay (just in case), and a new house.

But, best of all, it was easier to find a good life, because the level of pay inequality was at a cooler 38, rather than where it is today, a hotter 46. To get a feel for what that would mean for you on a day-to-day basis, consider how long it would take you to earn enough to buy a Basic Life Package (BLiP). No one sells BLiPs yet, but we think someone should. Here’s what you’d get, 4 years of tuition towards a BS/BA degree, a new car with 10,000 gallons of gas to go with it (or equivalent electricity, if it’s a plug-in), 2 week hospital stay (just in case), and a new house.

The chart shows how long it would take to earn enough to pay for a BLiP if you earned the median pay (50% of earners make more than you, and 50% of earners make less than you), and all of your money went towards paying for it. In 1968 the median pay was $8,630 and it took 2 years and 25 weeks. Despite the fact that median pay in 2008 was 6x higher, at $52,029, it still takes almost 3x longer (7 years and 32 weeks) to pay for a BLiP than in ’68. Because of the modern trend towards financing, the additional earning time required to pay for a BLiP is actually significantly longer than this. Feeling stressed? More time devoted to earning enough to pay for a BLiP means less time for you to be you. Not cool.

As inequality is reduced, pay for the vast majority of people goes up, causing the time required to earn enough for a BliP to go down. If you’re in the top 2%, you may be thinking, “I like the way things are now, and more equal pay means less pay for me”. That thinking, multiplied by many, is what’s helped to bring us the anemic GDP growth we see today.

What happens when you flip that thought to the much cooler, “If people don’t earn enough, then they can’t buy what I’m selling”? That kind of thinking helps to bring us something much closer to the ’68 economy, an expansion that wouldn’t quit. That’s good for business. It’s good for earners. it’s good for you.

Real talk from comedian Will Rogers in the 1920s nailed it this way:

“The money was all appropriated for the top in the hopes that it would trickle down to the needy. President Hoover didn’t know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night, anyhow. But it will at least have passed through the poor fellow’s hands.”

We can’t take you back to ’68. But, if you want to see how much better (or worse) your pay and life in the US could be if we brought the inequality temperature down (or up). Play with the Trickler. Find your ideal tempreature. It let’s you see how your pay, GDP growth, savings rates, drop out rates, homicide rates and democracy all change as earning becomes cooler (more equal) or hotter (less equal).

If you feel the heat, maybe you see the light, and, by now, you may be thinking;

“How can I be cooler?”

Wear shades and walk the talk this way:

1) Push for public policy and candidates who are cooler.

2) Make green choices. that are sustainable. This will keep the temperature down and the biodiversity up.

3) Make blue choices too. By this, we mean, choose the product or service that works for you and produces less inequality for everyone else. So, for example, Pay Day Lenders, some retailers and certain types of credit cards are not blue. Fair Trade, No-Sweatshop goods and services and our own Open Pay are blue. Blue is the new black, and blue action will keep the societal temperature down, grow the economy and improve democracy.

We also want to give a shout out to everyone who is NOT yet earning and wants to be. We know your attitude has changed, and we want you to know you’re not alone. We feel you. Stay strong!

|

hankort

Blue is the new black! RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() RFx140

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

RFx140

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() jfritchman

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

jfritchman

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

![]() staffordmasie

Those DM'ing about @openyear

: Check them out here; http://bit.ly/c8W1Gg

Cool concept re wealth sharing & distribution!

staffordmasie

Those DM'ing about @openyear

: Check them out here; http://bit.ly/c8W1Gg

Cool concept re wealth sharing & distribution!

![]() staffordmasie

Great articles! "How to be Cooler" from @openyear

http://bit.ly/cHbocn

Also see "How to be a Billionaire" http://bit.ly/dkXNMm

staffordmasie

Great articles! "How to be Cooler" from @openyear

http://bit.ly/cHbocn

Also see "How to be a Billionaire" http://bit.ly/dkXNMm

![]() BlackoutINK

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

BlackoutINK

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() CloudCounter

How to be Cooler : Openyear: http://bit.ly/9ywI0c

-As inequality is reduced, pay for the vast majority of people goes

up about

CloudCounter

How to be Cooler : Openyear: http://bit.ly/9ywI0c

-As inequality is reduced, pay for the vast majority of people goes

up about

![]() fergarcia1966

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

fergarcia1966

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() leashless

RT @ikostar:

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

[well that's damn cool - thank you! check this out]

leashless

RT @ikostar:

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

[well that's damn cool - thank you! check this out]

![]() adamdward

Oh man I want to be cooler. Interesting article about pay. Be green

and buy blue : http://bit.ly/9SrpYG

adamdward

Oh man I want to be cooler. Interesting article about pay. Be green

and buy blue : http://bit.ly/9SrpYG

![]() fredbartels

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

fredbartels

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() nitin

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

nitin

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() ntarunkumar

Make green and blue choices - great one! RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

ntarunkumar

Make green and blue choices - great one! RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() theeconomysucks

How to be Cooler : Openyear http://bit.ly/aawirw

theeconomysucks

How to be Cooler : Openyear http://bit.ly/aawirw

![]() danielbrandell

How to be Cooler : Openyear: http://bit.ly/aawirw

danielbrandell

How to be Cooler : Openyear: http://bit.ly/aawirw

![]() dabra

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

dabra

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() cornell2684

There is a parallel between the economy and the seemingly rising

temperatures

http://www.openyear.org/sharing-economy/how-to-be-cooler/

cornell2684

There is a parallel between the economy and the seemingly rising

temperatures

http://www.openyear.org/sharing-economy/how-to-be-cooler/

![]() niklasloven

How to be Cooler : Openyear http://t.co/9tSoshL

niklasloven

How to be Cooler : Openyear http://t.co/9tSoshL

![]() thebuckst0p

Interesting concept of cost of "Basic Life Package (BLiP)"

as economic measure http://bit.ly/caM0U5

thebuckst0p

Interesting concept of cost of "Basic Life Package (BLiP)"

as economic measure http://bit.ly/caM0U5

![]() 9000BC

http://www.openyear.org/sharing-economy/how-to-be-cooler/

be cooler...

9000BC

http://www.openyear.org/sharing-economy/how-to-be-cooler/

be cooler...

![]() Villavelius

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

Villavelius

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() ibnuharis

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

#fb

ibnuharis

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

#fb

![]() smehro

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

smehro

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() dalanhurst

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

dalanhurst

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() felixstang

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

felixstang

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() markus_breuer

How to really be cooler. Great food for thought and great facts and

numbers: http://bit.ly/90v7W8

/via @timoreilly

markus_breuer

How to really be cooler. Great food for thought and great facts and

numbers: http://bit.ly/90v7W8

/via @timoreilly

![]() kalenlee

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

kalenlee

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

grechaw

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() matthunte

RT @carpenterale:

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

matthunte

RT @carpenterale:

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() mariadeathstar

This is an insanely interesting perspective: RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

mariadeathstar

This is an insanely interesting perspective: RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() johnsicat

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

johnsicat

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() jstan

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

: timoreilly: Thought... http://bit.ly/dm5J3X

jstan

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

: timoreilly: Thought... http://bit.ly/dm5J3X

jcoleis

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() ikostar

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

ikostar

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

![]() rberger

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

rberger

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

![]() claudiaramos

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

claudiaramos

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() _Orwell

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

_Orwell

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

timcohn

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() juanviejo

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

juanviejo

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() carpenterale

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

carpenterale

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() coldacid

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

coldacid

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

Small Actions and the Big Zero

December 30, 2009 by Openyear

Filed under Sharing Economy

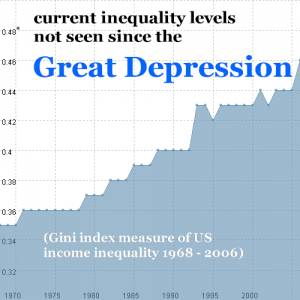

According to Nobel winning economist Paul Krugman, the last decade in the USA, amounted to no job creation, no gains for homeowners and no gains in the stock market. In economic terms, the decade was a Big Zero.

What Krugman failed to say in his NY Times Op-Ed, but has emphasized on earlier occasions (watch the video for details), is that the fatal weakness in the USA economy, for decades, has been income inequality. Lack of income means lack of purchasing power, and it’s the purchasing power that creates the markets that keep the economy going. It’s been the chronic substitution of credit/debt for fair earning that has eroded our economy, and brought on the Great Recession.

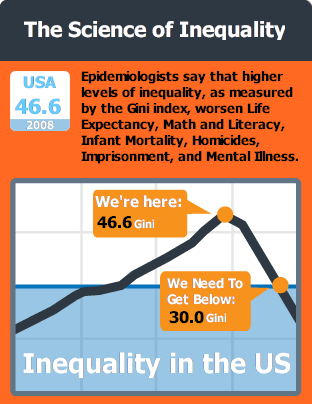

Well, as it turns out, research done by epidemiologists Richard Wilkinson and Kate Pickett show that inequality is also a fatal weakness in societies.

Using the Gini index as a measure for inequality – a Gini of 100 equates to 1 person having all the income and everyone else having none – a Gini of 0 equates to everyone having the same income, Wilkinson and Pickett have found that countries with higher inequality (Gini) all do worse across many societal vital signs. Ginis for some selected countries are as follows: France = 28, India = 36.8, China = 46.9, Brazil = 56.7. You can check the level of inequality for your country on Wikipedia.

Rising inequality worsens Life Expectancy, Math and Literacy, Infant Mortality, Homicides, Imprisonment, Teenage Births, Trust, Obesity, Mental Illness (including drug abuse) and Social Mobility. With a Gini of 46.6, the US scores poorly and, in some cases, off the charts in all of these areas. Think of the resulting transformation, if a portion of all the money diluted attacking these as separate problems at the end, was instead focused on the single purpose of reducing inequality at the beginning! We’re working on opening pay to help with that. Watch the video below to see how Wilkinson and Pickett break it down.

If you want more, and will be in the USA in January, they’ll be on book tour for The Spirit Level: Why Greater Equality Makes Societies Stronger in Atlanta, SF, Seattle, Chicago, NY and DC.

Prights: Rights Delivered as Products

November 3, 2009 by Openyear

Filed under Sharing Economy

Take a minute and listen to US President FDR calling for an Economic Bill of Rights in 1944 to provide prosperity and security for all. It’s refreshing and inspiring. Unlike most people in government today, he speaks plainly, forthrightly and without qualifiers. The first, and most important, right he calls for is “The right to a useful and renumerative job that earns one enough to pay for food, clothing and recreation”. He also calls for ” Rights to decent housing, medical care and education”.

The bulk of the economic rights FDR called for seem less likely to be delivered by most governments today than in his time. Declarations of rights often require foresight and courage. But, that’s the easy part. The hard part is provisioning the right in the real world so that people can actually take advantage of it.

In the 65 years since FDR’s call, many millions of products have been delivered by companies. Some of these products, especially in the last 8 years, have become ubiquitous and mostly free. They’ve essentially made certain rights real in practice. All they lack is a legal declaration. We call these “product rights”, or prights. Some examples follow:

| Product | Right |

| Skype | The right to talk to anyone anywhere. |

| OpenPGP |

The right to private digital communication. |

| MIT Open Courseware |

The right to a world class undergraduate curriculum. |

| Google Books |

The right to access the world’s largest library. |

| Grameen Bank |

The right to entrepreneurial capital at reasonable rates. |

Of course, most of these prights, in turn, depend upon one having a broadband connection. Which, itself, has been declared a human right in France and a legal right in Finland. We see these declarations by France and Finland as excellent examples of polivation; smart public policy that drives innovation to benefit everyone. We predict that a right to bandwidth will spread globally in the years to come, as policy makers understand that access to bandwidth underpins many of the prights which their people want.

We’ve noticed that the difference between a right and a wrong, or a pright and a prong comes down to how things get shared. So, for example, the pright, Grameen Bank, emphasizes relationship and charges a reasonable interest rate for a loan. By contrast, the prong, Pay Day lenders, often charge triple digit interest, resulting in earners at the low end transferring many multiples of what they’ve borrowed upwards. When FDR speaks of a “useful and renumerative job that earns one enough to pay for food, clothing and recreation”, he’s speaking about a pright dynamic.

What happens when sharing is built into earning, like interest is built into lending? Would that help shift us from a debt economy to a sharing economy faster? What happens when datapoints provided by you are used to continuously and automatically discover, plan or create your next job (or education), so your livelihood is never interrupted? Would that help make the economy more stable?

Prights such as these help move the world closer to FDR’s vision. But, there’s no formal mechanism like political parties and voting by which we can call for them. So, if you like prights, support them with at least the same enthusiasm you may have given Obama or McCain; because the global constitution is being written in code (software), and we need a global Bill of Prights to go with it.

EARNDEX

October 25, 2009 by Openyear

Filed under Sharing Economy

Both the New York Times and Google News, 2 of the leading sources of news on the web, prioritize their top news categories similarly, as follows: World, US, Business, Sci/Tech, Sports and Entertainment. Arguably, 2 thirds of these categories (Business, Sci/Tech, Sports and Entertainment) make implicit calls to consumption; either in the content, or through surrounding ads. Whether it be the purchase of financial services, gadgets, tickets to sporting events or the latest video games, the framing of the news favors consumption.

But, what about the other side of the ledger? Where are the (sub) categories that implicitly speak to the earning (or lack of it) that makes the consumption possible in the first place?

It got us thinking, “if stock indexes are great for giving the investor a heads up, why not an earner index, or EARNDEX, that gives earners a heads up, by tracking categories of interest to earners, or those who aspire to be earners”. EARNDEX tracks categories such as ‘joblessness’, ‘middle class’, ‘poor’, ‘top 1%’, ‘wealth sharing’, ‘wealth gap’ and so forth that get at the life long challenge of earning.

The news cycle drives the economic and political cycles. Each day, EARNDEX allows you to see the % of the news cycle devoted to a given category relative to the others. So, for example, we’ve observed that the top 1% and the poor routinely get more coverage than the middle class. You can also see how news share for each of the categories compares from week to week. Use EARNDEX to stay informed on the news that matters most to your livelihood.

We’ve been following Michael Moore, and while we don’t agree with him on everything – for example, we believe capitalism itself is not the problem, but rather the problem is parasitic business cultures that have forgotten how to be symbiotic – we thought he kept it real when he was interviewed on Democracy Now. Take a look.

Polivation

August 25, 2009 by Openyear

Filed under Sharing Economy

If you don’t know who Robert Shiller is, you should. He’s the Yale economist who predicted both the dot com bubble and the housing bubble that has brought on the current financial crisis. He’s someone we should listen to. His latest book, Animal Spirits, co-authored with Nobel economist, George Akerlof, as usual, lights the way. In it, they argue that capitalism works better when we acknowledge and account for human behavior, rather than having blind faith in the “rationality” of markets.

So, what does Robert Shiller see as our greatest problem today?

In conversation with Charlie Rose he said, “The biggest problem facing this country (US) is not the (financial) crisis, but the growing inequality”. Further adding, “Inequality is worse than we thought because people who are poor will die younger.” You can hear Robert Shiller speaking with Openyear here.

Robert Shiller and Leonard Burman offer a public policy solution to inequality they call The Rising Tide Tax System. Their key idea is that the tax rate on super earners should automatically rise as inequality rises. We thought we might compare it to our influence based approach, Open Pay, to see how they may complement each other.

| Category | Rising Tide Tax System (RTTS) |

Open Pay |

| Scope | USA |

Global |

| Control | Centralized (US Federal Government) |

Distributed (individuals, organizations, Openyear) |

| Mode |

Coercive (penalties for non-compliance) |

Volitional (positive social rating for participation) |

| Dependency |

Indirect – US Congress & President |

Direct – Individuals and Organizations opting in |

| % Contributed by Super Earners |

Absolute – Driven by Inequality Index |

Relative & Situational – Driven by Earners & Reputation |

| Cents on the Dollar Reaching Public |

$0.23 | $0.91 |

| Directly Benefits People Not Working |

Yes | No (not initially, but aim is to benefit some unemployed in mid-term) |

| Directly Improves Productivity | No | Yes (merit based) |

We calculate “Cents on the Dollar Reaching Public” as follows: According to the Tax Foundation, $0.23 of every tax dollar collected is consumed in compliance costs. Of the remaining $0.77, according to War Resistor’s League, 70% of every tax dollar is spent on non-human resource categories (excluding social security). This nets to $0.23 of each tax dollar directly reaching the public through social spending – actually it’s significantly less if we subtract administrations costs. This compares against $0.91 of each Open Pay dollar reaching earners.

So, Open Pay is roughly 4 times more efficient than the RTTS in terms of its impact on inequality. Or, in other words, the recommended minimum 3% super earner contribution to Open Pay is equivalent to 12% under RTTS . RTTS has the great advantage that it benefits people who can not earn, and can be used to fund large scale projects that benefit everyone, rather than simply putting more money in more hands as Open Pay will. Both have their role.

The RTTS got us thinking about the possibility of social business integrations with the US tax code, as happens, say, today with energy industry tax credits. More polivation, public policy and entrepreneurial innovation, working together, like bees and flowers, will probably be needed to boost the harvest.

The Selflessness Signal

May 31, 2009 by Openyear

Filed under Sharing Economy

2006 Nobel Peace Prize winner Muhammad Yunus speaks with Bill Maher about normalcy. Bill points out that the old normalcy was to consume more than we earned to keep the economy going.

Muhammad adds that exorbitant Pay Day lending, pawn shops and check cashing companies are examples of a twisted, rather than “normal” economy. He calls for a new normalcy built on social businesses that recognize the selflesness of human beings and their desire to create positive change.

The crowd applauds. Maher suggests that they applaud because they decry selfishness, not that they’re necessarily agreeing with Muhammad. Muhammad insists they agree because he gets the “signal”. The crowd applauds louder!

They feel it. MBAs at Harvard are feeling it. The Selflessness Signal is rising.

Check out the video below, and let us know if you’re feeling it too?

‘It’s good to share’ Video

May 11, 2009 by Openyear

Filed under Sharing Economy, Earner Video

Do you care about the world? Are better health, reduced violence, more trust, improved child well being, and a faster growing economy important to you? Well, it turns out that all of these are related to the level of wealth sharing. Countries with higher levels of equality do better in all these areas (and others). Countries with lower levels of equality do worse.

So, for example, an economy is slowed when money must be spent on protection – armored cars, body guards etc. – as happens in highly unequal countries, like Brazil and Mexico. Whereas, in countries that share wealth better, like Japan and Sweden, this money is put to more productive use.

When a cruise ship is sinking, it begins to list to one side, the furniture slides, the engine may fail, the passengers may panic and become abusive. Time and effort to address each of these problems will yield results. But, fixing the leak and pumping out the excess water is the best use of the crew’s time, as it helps resolve all the other problems.

Wealth sharing is like fixing the leak and pumping out the excess water on a sinking ship. This may be the single best thing we can do to help ourselves and the world at the same time. If you doubt this, consider that the financial crisis is the result of millions of people doing the worst deals around closed credit products, where known downstream implications of a purchase, like wealth destruction and exacerbating inequality, were intentionally obfuscated.

By contrast, open products like organic foods, hybrid cars, and renewable energy, come with more information on downstream sustainability. Open products empower us to be the change we want to see in the world through the informed choices we make. If you want change, why not maximize your impact by joining with all the other people who’ve agreed to share wealth by opening their pay? By the way, it turns out that countries who share wealth better even recycle more – just in case you needed one more reason. Take a moment to check out our video, and tell a friend all the reasons why it’s good to share.

Introducing Earner Video

March 7, 2009 by Openyear

Filed under Sharing Economy

Consumer oriented media is the rule. That is, whether we’re on the web, watching TV, or listening to radio, the default emphasis – whether explicitly in advertising, or implicitly, in the content itself – is to consume (a lifestyle). The default assumption, is that we have the income with which to consume. Media oriented towards the earning that makes the consumption possible is the exception.

We’re introducing Earner Video to help restore some balance. Like cartographers, our aim is to begin mapping the earning landscape, and, then, with your help, show the best routes to better earning.

Check out Earner Video here.

A pre-Mercator nautical chart of West Africa from 1571, by Portuguese cartographer Fernão Vaz Dourado (c. 1520-c.1580)

Economist Robert Shiller’s Openyear Interview

January 9, 2009 by Openyear

Filed under Sharing Economy

Journalist Mitch Ratcliffe spoke with economist Robert Shiller in an Openyear sponsored interview on some of his ideas put forth in his seminal book,The New Financial Order. In it, he says that finance should serve people directly to help reduce their risks, not just remain a tool of business.

Journalist Mitch Ratcliffe spoke with economist Robert Shiller in an Openyear sponsored interview on some of his ideas put forth in his seminal book,The New Financial Order. In it, he says that finance should serve people directly to help reduce their risks, not just remain a tool of business.

He foresaw the internet and housing bubbles first, and coined the term irrational exuberance. He has proposed innovative tax policy to help reduce US inequality.

Here is some of what he and Mitch discussed.

Humans are the most important part of the economy.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

Livelihood Insurance is extremely important to our development.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

Unions should think creatively about uncertainty and find risk solutions.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

People will share their future upside income for support early on.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

We haven’t allowed human capital to be risk managed as financial capital has. It needs to be democratized.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

Sharing the Wealth is Good for Everybody

January 2, 2009 by Openyear

Filed under Sharing Economy

During the 2008 Presidential campaign Barack Obama spoke with a plumber named Joe in Ohio about his tax plan. Here’s how it went.

Obama points out to Joe the plumber that “spreading the wealth around is good for everybody”.

Why did he say this? Perhaps, he is familiar with the history of the Great Depression. Mariner S. Eccles, FDR’s Fed Chariman from 1931-34 concluded in his book, Beckoning Frontiers: Public and Personal Recollections, that inequality was the main cause of the Depression. Mariner put it as follows:

“A giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth.”

“A giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth.”

“The United States economy is like a poker game where the chips have become concentrated in fewer and fewer hands, and where the other fellows can stay in the game only by borrowing. When their credit runs out the game will stop.â€

In other words, if earning is not well distributed, the economy stalls, because people lack the purchasing power to keep it going.

Inequality has also been shown to shorten life expectancy for those in the bottom 80%, with the difference between super earners and earners amounting to about 2 years on average. While it may not seem like much, this is equal to the gain in life expectancy society would receive if cancer were cured, as Larry Summers explains below:

Obama’s rival John Mccain later responded in a radio address with:

“As Joe the Plumber has now reminded us all, America didn’t become the greatest nation on earth by letting government “spread the wealth around.” In this country, we believe in spreading opportunity.”

Both McCain and Obama are right. But, it begs the question, Why isn’t opportunity itself spreading the wealth as well as it once did?

Like global warming, the root cause comes down to the economy not fully accounting for the consequences of what we do. In the case of global warming, the harm that invisible carbon gases do has remained economically invisible, because we’ve failed to price it. Out of price. Out of mind.

As essential as carbon is to life, influence is just as essential to work life. Like carbon gas, influence is economically invisible.

Skill or know how, is visible in the form of diplomas, degrees and resumes. So, salaries tend to be set by visibles, like skill scarcity. But, know how is only half of how we earn. There’s also know who, know what, know when and know where passing between people, or influence.

Because skill is embodied in a single person, it is atomic and individuated. By extension, closed pay approaches based on skill , exclude others, are 1-way and tend to concentrate more money in fewer hands. In contrast to skill, influence is social evidence that no one does it all alone. By extension, open pay approaches based on influence include others, are multi-way and distributive, and place more money in more hands.

In the same way that governments do not expect to solve the problem of global warming alone, but instead rely on companies pioneering green technologies, neither can governments solve the problem of inequality alone. Like global warming, it’s too big.

But, together we can reduce it, by choosing to, open our pay to one another. With your permission, Openyear can help to make influences between us visible, so that how we’re paid better reflects what we do

with the opportunities we get.