Trickler

“Trickle down”, “Trickle Up”. Ever wonder who came up with the phrases? Will Rogers. He originated the terms, “trickle down” and “trickle up” back in the 1920s, and was one of our inspirations for the Trickler. The Trickler lets you see how your pay and society would change in a more equal or less equal US.

“Trickle down”, “Trickle Up”. Ever wonder who came up with the phrases? Will Rogers. He originated the terms, “trickle down” and “trickle up” back in the 1920s, and was one of our inspirations for the Trickler. The Trickler lets you see how your pay and society would change in a more equal or less equal US.

Here’s how Will coined it back in the day.

“The money was all appropriated for the top in the hopes that it would trickle down. to the needy. President Hoover didn’t know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night, anyhow. But it will at least have passed through the poor fellow’s hands.

All one had to do was look at what happened to the money loaned to the railroads and smaller banks. They had not used it to create jobs. Instead, they paid off their loans to the New York banks. So the money went uphill instead of down. You can drop a bag of gold in Death Valley, which is below sea level, and before Saturday it will be home to papa J. P. Morgan”.

If you don’t know who J. P. Morgan was, he, basically, ran American industry in the early part of the 20th century. Today, he has no equivalent. We looked around for an equivalent to Will Rogers to get the latest chapter in the trickle story, and we found this guy Stephen Colbert. Maybe you’ve heard of him?

Before watching Steve’s video, please take note of our disclaimer. We’re independent and entrepreneurial, not political. We also love super earners, earners and the unemployed equally, and believe we’re all in the same economic boat, because what goes around comes back around again. So, by rowing together, we’ll all get to the shores of win-win faster.

Will got at a universal truth when he said, “Americans were saved by their good humor during hard times: the worse the situation, the more Americans laughed.” We would only add that we observe that this is true of people everywhere. In these hard times, it follows, then, that the more you’re feeling the heat, the more likely you are to find Steve’s satire funny. But, even if you’re in the top 3%, as he is, it’ll probably make you smile just the same.

Try the Trickler out at the bottom of the page. It’s set to an inequality temperature of 38, the lowest ever recorded in the US, which we hit back in 1968. But you can change it to whatever temperature you like (100 degrees means 1 person has all the pay and you have none, 0 degrees means everyone has the same pay). Enter your salary and click. If you’re like most people, you’ll see your salary rise at 38 (the US is at 46 now).

Play with it to find the temperature that works for you. It turns out that inequality, like body temperature has a systemic impact. It not only drives your pay, but GDP growth, savings rate, high school drop out rates, homicide rates and democracy. Openyear’s Open Pay will allow you to set your personal temperature to negotiate how pay is shared between people you influence and you.

After you click, you’ll be taken to an expanded version of the Trickler that displays your new pay in a more equal or less equal US, along with 5 gauges showing how conditions would change in the US in response to the change in inequality. Data for the gauges were drawn from the following sources:

Inequality, Growth and Poverty in the Era of Liberalization and Globalization

High Income Disparities Leads to Low Savings Rates

Why is Violence More Common Where Inequality is Greater?

Inequality and US High School Drop Out Rates

On the Relationship between Political Inequality and Economic Inequality: A Cross-National Study

Raise a glass of your favorite beverage (with lime) this Labor Day to remember all the earners who aren’t earning enough, or not earning at all. Or, better yet, invite them over and feed them. And, don’t forget to have a good laugh!

How to be a Billionaire

All total, there are 372 billionaires in the US worth about 1.3 trillion all together. That’s the same as 13,146,371 median (those exactly in the middle) net worth families. If you have trouble visualizing $1 billion, take a look at the image below. It’s $1 billion stacked in $100 bills. Each cube is worth $100 million.

courtesy of www.methodshop.com.

courtesy of www.methodshop.com.

Again this year, Bill Gates and Warren Buffett topped the Forbes list of US billionaires. We applaud them, not just because they’re Olympian earners, but also for the enormous good they do through the Bill and Melinda Gates foundation. Combined, they’re worth about $100 billion. Forbes classifies them as “self made” billionaires, as they did not inherit. But we offer an alternate classification, “ earner made”.

Warren Buffett (left) and Bill Gates (right) playing bridge. photo by: Ethan Bloch

What you earn makes consumption of Windows, Coca Cola, Google Ads, or iPhones, by those who depend on you, possible. Billionaires don’t become billionaires based on salary, they earn based on the trickle up of the consumption you enable, combined with ownership of a large percentage of a company’s stock. You turn their genius into wealth.

Why is the Forbe’s billionaires list their most popular piece year in and year out? For some, it’s an occasion to ooooh and aaaah. For others, an occasion to rant against the rich. But, how does it inform or affect the lives of a typical earner, like you? If you’re a golfer, you might study Tiger Woods. For chess, Gary Kasparov. For snow boarding, Shaun White. For earning, why not study billionaires? We thought we’d take a closer look at the self/earner made Forbes data for you to see if there was anything there that could help you become a billionaire.

Option 1. Be in the right place at the right time.

| Otherwise known as, inheriting your wealth. If you can pick your parents well, this is the easiest way to go. But, be forewarned, most billionaires are self/earner made, and those who are have an average net worth of about $3.5 billion, vs. $3 billion for those who inherit. |

Option 2. Be in the right place at the right time with the right action.

In response to the Great Recession, many have called for more education to help prepare earners for new jobs. The Forbes US billionaire data adds color to this generic recommendation. It turns out that amongst billionaires, we notice a freakonomical result. Those with the least formal education, drop outs, have the highest average net worth. Those with the most formal education, PhDs, LLDs and MDs the lowest average net worth. But, there is not quite an inverse relationship between formal education and net worth. Those whose highest degree is either an MBA or MS are greatest in number, and have the second highest average net worth, after drop outs.

Take Away: We think this suggests that billionaires value scarce and timely consumer and market knowledge over academic knowledge, and take action to get it. But, if you’re going to get a degree, get a Masters, preferably an MBA.

For those who complete a formal education, the right places appear to be, by far, Harvard U., followed by Stanford U., Columbia U., MIT, U. of Chicago, U of Penn., NYU, U. of Texas, UC Berkeley and USC. Billionaires graduating from these 10 schools created about 39% of all billionaire wealth.

Apart from what they learn at these institutions, we think one undervalued benefit of graduating from them is the trust these university names engender in potential backers, clients or employers, relative to, say, Wasamata U. This seems to be underscored by their first names too.

The most prominent first names among them are John(17), David(13), Steven(13), George(8), James(7) and Charles(7), primarily biblical names, or names of great historical figures, that people are more inclined to trust. In general, billionaires don’t have unusual first names. Of course, there is the exception, the one and only Oprah. She’s the only US self/earner made woman billionaire, and the only non-Asian minority billionaire. We believe she succeeds in large measure because she’s been able to build trust through her television persona. Otherwise, the self/earner made US billionaire list is more than 97% white male.

Take Away: Your ability to earn rises with how much others trust you. If you don’t have a pedigree from one of the schools listed above, a common biblical or historical first name, or look like a billionaire, you’ll have to take action to cultivate more trust. If you’ll be naming a baby soon, it’s something to consider.

The average age of a self/earner made US billionaire is 66. But the average age varies by industry. It goes from youngest to highest as follows, internet/software (52), investments/finance (64), electronics/semiconductors (65), oil/energy (65), retail/apparel (67), manufacturing (68), media/entertainment (68), and real estate (73).

Together, these 8 industries comprise 64% of self/earner made US billionaire wealth. Setting aside the outlier industries, internet/software and real estate, where average ages are significantly higher or or lower, we see that their birth dates cluster around the end of WWII. They were lucky enough to be born into the greatest economic expansion the US has ever seen. Timing matters.

Take Away: Look to earn and own stock within industries and countries that have the potential for strong growth over the long term. Health, Genomics, Green industries, Space, Internet, China, India and Brazil are all worth considering.

Option 3. Be in the right place at the right time with a nudge.

If you live in Alaska, the Dakotas, Iowa, New Mexico, Louisiana, Mississippi, South Carolina, West Virginia, Delaware, or Maine there are no billionaires living in your state. If you live in any of the others, you have at least 1 billionaire residing in your state.

Let’s say you’re already 66, or are a woman, or didn’t graduate from a premiere school, or your first name is Osama, or you don’t have a head for business, then what? Well, click on the adjacent billionaire map. Find your state. Click on the white billionaire icon. See the list of billionaires living in your town. If you happen to run into them at an airport, restaurant, spa or wherever, very politely nudge them to open their earning to the earners that put them where they are using Open Pay, or the service of their choice. This means reserving a % of their earning for distribution to earners in the bottom 99% based on their influence on them. This won’t make you a billionaire, but it will help make trickle down a reality.

Billionaires are like everyone else, they may know the right thing to do intellectually, but to get them to actually do it, takes nudging.

Chances are your local billionaire already has a favored philanthropy. Point out that opening his pay will very likely help him to achieve his philanthropic goals faster. Using the Gates Foundation, as an example, epidemiological research shows that 40% of the problem areas on which they’re focused are, themselves, exacerbated by gross inequality, itself. The adjacent table shows the match up.

| Gates Foundation Problem Focus | Problems Worsened by Inequality |

| nutrition, pneumonia, HIV/AIDS | physical health |

| tobacco | drug abuse |

| early learning, high schools | education |

| financial services for poor | social mobility |

| family planning | teenage births |

| maternal, newborn and child health | child welll being |

Let your local billionaire know that the middle class is hurting, and they have a responsibility not just to the poor, but also to the middle, who put them where they are. To paraphrase Warren Buffett, “If you’re in the luckiest 1 per cent of humanity, you owe it to the rest of humanity to act on behalf of the other 99 percent.”

Comments

-

How to be a billionaire Step 1 - either drop our of school or get an MBA (or pick billionaire parents): http://bit.ly/9pQ8Xv

-

nice overview: boils down to right place, right time (luck) RT @ jhagel: How to be a billionaire - interesting analysis http://bit.ly/9pQ8Xv

-

How to be a billionaire - interesting analysis http://bit.ly/99w9Nf

-

HT. Neal Kohl...Worth the read on openyear.org. http://bit.ly/99w9Nf

X Jobs

Both Robert Reich and Leo Hindery are among the few speaking up to make sure the economy works for you! Outspoken and smart, they’re also very cool, with Leo and his crew winning at Le Mans in 2005, and Robert, more recently, making his hilarious comedy debut with the help of Conan O’Brien.

Unlike the vast majority of people you hear speaking on the economy, they put earners first – with a laser focus on jobs. They get that growth depends on fair distribution of pay.

Listen to how they kept it real, as Leo was interviewed, independently, on the Leonard Lopate Show out of NYC, and Robert was interviewed on the Michael Krasny Show out of SF.

|

Leo Hindery |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Leo points out that real unemployment in the US is at 20%. The average full time earner only works 33 hours. |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Leo’s turnaround plan calls for large scale infrastructure investment, youth employment and buying domestically to create jobs in the US. |

|

Robert Reich |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Robert breaks down the various economic factors contributing to consumer (earner) trauma. |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Robert says 23.5 % of pay goes to top 1%. Up from 9% of pay in the 1980s. This is a structural problem that’s been building for years, only now made visible by the Great Recession. |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Robert’s turnaround plan calls for a large second stimulus, resurrection of the WPA, and investments in education, particularly at the community college level. Note: listen closely to the Ivy League/UC Berkeley educated MBA living on 20% unemployment at the start of the clip. More on that later. |

They both agree that the numbers of people in the US out of work is so great (11 million+), that neither the Federal stimulus, nor any bills proposed, are large enough to get everyone back to work. Just like when you need more acceleration to pass the motorist in front of you, they’re calling for more stimulus so we can accelerate through the Great Recession faster, and return to propserity. But, the highway to a second stimulus bill may be closed when we have US Senators blocking the, far less costly, simple extension of unemployment benefits with road signs that say, “tough shit“.

When we’re 11 million jobs in the hole, and we need to create 1.5 million jobs each year, just to keep pace with population growth, we need a Plan B. When unemployment is at roughly 10%, and is projected to remain at 8% until 2014, we need a Plan B.

We need a plan B.

At the start of the third Reich audio clip, you’ll hear an Ivy League/UC Berekely educated MBA, living on unemployment, at 20% of his normal earning. He testifies as to how hard he’s trying to find work, and how little he likes being on the dole. He’s smart. He’s educated. He’s out of work. Why, when education is often given as the key to avoiding unemployment, are so may well educated people unemployed? We offer 3 reasons.

Earners can’t properly plan.

While we can have some idea of what the price and availability of oil, or soybeans will be in a year, thanks to future’s markets; we can’t do so with MBAs or janitors. Odds on every legitimate sporting event are forecast. Weather is forecast and broadcast. Corporate earnings are forecast and broadcast. But, for the most crucial economic indicator in your life, your future earnings, there’s NO forecast!

You can’t blame companies. Chances are they know of potential layoffs long before you do. But, it’s in their best interest to keep the information secret as long as possible, so as to not impair productivity, or trigger an exodus of their best people. If earners want to be able to plan smooth transitions, as companies do, then they”ll need earning forecasting, by occupation and locality. Odds are, they’ll have to build the forecasting system themselves and feed it data too, because no one else will be motivated to do it.

Earners weren’t properly prepared for the future.

Academic degrees have their historical roots in medieval trade guilds, where the emphasis was placed on trade mastery. The top 10 in demand jobs of 2010 did not exist in 2004. This accelerated rate of change means the most important subject to master is the future. We must work backwards from the future, to anticipate problems and jobs that don’t yet exist.

Money that could be used to pay earners is wasted because it’s not time leveraged.

When “An ounce of prevention is worth a pound of cure.” meets “Where’s the pain?”, “Where’s the pain?” usually wins. So, expensive ER and “heroic” medicine prevails over wellness. $23K on average is spent per prisoner vs. $10K per student. And, to quote former US Treasury Secretary, Hank Paulson, “It’s very difficult to get Congress to act on anything that is big and complex and controversial if there is not an immediate crisis”

Given the average cost to educate a student, and the average cost to incarcerate a prisoner, on a GDP basis, we’re better off with more prisoners. Quantitatively this makes sense. But, qualitatively, we know it does not.

It is, in part, because we fail to use qualitative measures that the US economy is rampant with money wasted on later stage crises, that could be use to pay earners; if only it were profitably leveraged at the beginning to reduce the risks in the first place. More teachers are a qualitatively better use of money than more prison guards.

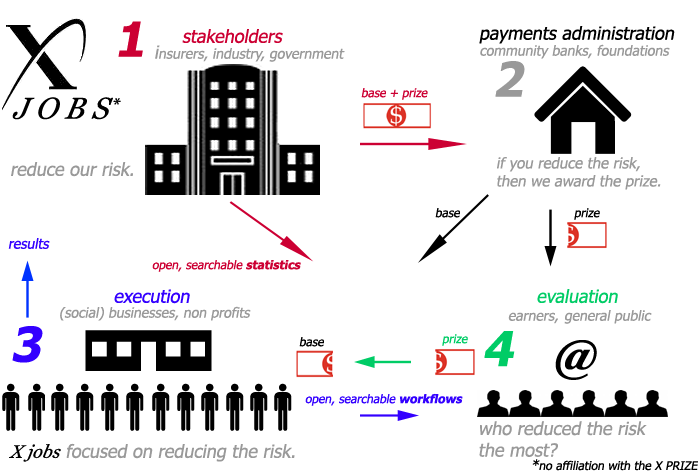

Which brings us to X Jobs. You may be familiar with the X Prize, whose mission is to “create radical breakthroughs for the benefit of humanity thereby inspiring the formation of new industries, jobs and the revitalization of markets that are currently stuck”. They’ve opened the door to a new industry of space tourism through the Ansari X Prize, won by SpaceShipOne. Basically, they offer a $10M prize for any group that is able to achieve a breakthrough, the specifics of which, are layed out by the sponsors of the prize.

X Jobs would follow a similar line, except that rather than emphasize narrowly focused breakthroughs, that typically favor small groups of high earning PhDs, X Jobs would emphasize broad societal risks, that favor large groups of average earners.

For example, car crashes kill about 44K people per year, making it the 6th leading cause of death in the US. About 1/3 of those deaths are caused by drunk driving. The cost to motorists is about $160B per year in lost life, property damage, lost earnings, medical costs and so on. If even a small fraction of this many people were killed in a terrorist attack, we would move heaven and earth to prevent it. But, for some reason, we tolerate these deaths, which occur reliably, like the sunrise, year in and year out.

Let’s take a look at how X Jobs might work for car crashes.

1 Stakeholders: Insurers are paying life insurance, disability, medical costs and property damage claims. Counties and municipalities are paying for medical costs and clean up. Industries are paying with lost earners and lost productivity. These and other crash related costs amount to $160B.

Stakeholders sponsor a prize valued at 5% of what they’re spending now on crashes, in exchange for a 10% reduction in collisions in the succeeding year(s). This amounts to an $8B prize, equivalent to about 3 1/2% of the stimulus at its peak. Essentially, stakeholders would receive a $16B reduction in costs, in return for $8B, or a 100% return on their money.

50% ($4B) of the money is paid out immediately in base pay to fund the effort. 50% is withheld as a prize, only to be awarded, if the reduction is achieved. Sponsors risk a potential loss of $4B, against a potential gain of $8B, should the goal be met.

Open Data: the sponsors also agree to share relevant, real time statistics, such as when, and where collisions occur with evaluators as soon as the data is available.

2 Payments Administration: Unlike the X Prize, X Jobs have many potential winners. Community banks and Foundations with local knowledge act as fiduciaries. They process applications for funding from (social) businesses and non-profits. They administer payments and contribute their knowledge where useful. For this, they take a 5% fee, leaving $7.6B.

3 Execution: Businesses, non-profits like Mother’s Against Drunk Driving and new organizations formed to meet the challenge, apply for and receive base payments. They set about reducing collisions by any legal means necessary. If that means parking outside the bars and clubs at 3AM and offering free rides, that’s what they’ll do. To persuade evaluators that their efforts are more prize worthy than others, they can choose to make what they do transparent and searchable. Openyear can help with that. So, for example, club-to-destination-zip-code GPS record of each drunk person driven home from the club would count in their favor.

4 Evaluation: Earners and the public who are not affiliated with sponsorship, administration or execution are invited to be prize judges. Over the course of the year(s), they follow what people are doing and how the statistics are changing to reach consensus on which organizations/persons are contributing the most towards the overall goal of reducing crashes. The prize (bonus) is awarded to organizations/earners by the Payment Administrator based on their decisions.

If we subtract 1/3 ($2.53B) for execution infrastructure and dedicate the rest to earners, this creates slightly over 100K, $50K jobs. Not much, given how far we are in the hole. But, when you add up all the societal risks we know of that we could tackle with the X jobs model, it easily exceeds the stimulus in sheer dollars. What’s more, it shifts the focus towards where to spend to get the most leverage – biggest bang for the buck – rather than simply levels of spending.

When Eisenhower was US President, we built Interstate Highway infrastructure to better move goods from the State to State. It worked. The US grew. By comparison, the X Jobs infrastructure to move money and information between entities is trivial. Many economists are saying that the US is moving into a permanent condition of high employment. This doesn’t have to be. Reich and Hindery have sounded the alarm. What are we going to do? People dying on the roads and suffering from unemployment can’t wait for Congress. We need a Plan B, and we need it now. We need X Jobs. If you’re feeling us, contact us at info@openyear.org, or sign up at right.

Move Your Money

|

U2’s front man, Bono, points to People Power and the Upside-Down Pyramid as one of the big ideas that’s going to make the next 10 years more interesting. He says, “Increasingly, the masses are sitting at the top, and their weight, via cellphones, the Web and the civil society and democracy these technologies can promote, is being felt by those who have traditionally held power.” Or, as the band has paraphrased lyrically, from their song Silver and Gold, |

Captains and Kings in the ship’s hold

They came to collect

Silver and gold, silver and gold.

I seen the coming and the going

Seen the captains and the Kings.

Seen their navy blue uniforms

Seen them bright and shiny things, bright and shiny things.

The temperature is rising

The fever white hot

Mister I ain’t got nothing

But it’s more than you’ve got

These chains no longer bind me

Nor the shackles at my feet

Outside are the prisoners

Inside the free (set them free).

A prize fighter in a corner is told

Hit where it hurts – For Silver and Gold

You can stop the world from turning around

You just gotta pay a penny in the pound.

We don’t know if blogger Arianna Huffington, film maker Eugene Jarecki, and financier Robert Johnson were listening to Silver and Gold when they hatched their plan for the Move Your Money movement, but they’ve given life to the lyric.

Frustrated with the lack of financial reform of the banking system, and the lack of remorse from the big bankers that brought on the Great Recession, they’re encouraging people in the US to vote with their dollars, and move their money from large banks to community banks to better support their communities. Whether in a large bank or small bank, your money is equally safe because FDIC insures all accounts up to $250K. But, still, you may be wondering, “why should I bother”?

The official Move Your Money video below uses the 1946 film, “It’s a Wonderful Life” to explain why moving your money matters. It’ also happens to be one of our favorite films, so much so, that we ‘ve used it in our Open Pay video (at right).

To the reasons already offered to make the move, we’d like to offer a couple of our own. First, if you’re credit worthy and can’t get a mortgage, car or business loan, you may want to think of access to credit as a pright – a right provisioned as a product.

Your community bank likely makes most of its money on straight forward loans that they, themselves, hold, not on opaque derivatives trading, as many large banks do. So, your small act(s) of moving dollars to them, helps provision a pright to credit within your community more reliably than voting for a candidate who promises the same.

Second, think about what bankers in your community earn, relative to bankers at large banks. Chances are it’s a number considerably closer to what you earn yourself. Your small act(s) strengthens their position and reduces inequality – shown to weaken the economy overall and is the source of many social problems.

If, like us, you’re looking for the Big Plus over the next 10 years, rather than a repeat of the Big Zero (no job creation – no home appreciation -no stock market gains) that we’ve had over the last 10, ask your self this question, “Is my purchase, support or other economic acts going to send money upwards or pull it down?” Moving your money to a community bank is a great way to pull it down. It keeps your money circulating where you live – to better benefit your family, friends and neighbors.

If you want more info, you can watch Robert Johnson explain on Democracy Now how Move Your Money got going. And, remember, the economy exists to serve U 2. It’s not just the GDP, it’s the Gini. Or, in other words, it’s not just the size of the pie that counts, it’s also how the pie gets sliced which keeps us all well!

Happy Earner (Labor) Day

Childbirth is classic labor. It’s painful, arduous, sweaty and miraculous. Most of us don’t consider ourselves laborers anymore, and for those that still do, the thinking to laboring ratio keeps going up. We owe a great debt to the laborers of the past who brought Labor Day to the US 115 years ago, during a time when child labor and 7 days per week, 12 hour work days were standard through out the industrialized world. They changed the norms such that we now expect kids to be educated, rather than made to work, and we believe weekends off and retirement are normal. CEOs and everyone else have benefited from their efforts.

What’s different today is “how” we work. There are easily 100 times as many kinds of jobs today as there were in the 1890s when Labor Day began. The “how” defies broad classification. But, the “why”, does not. Whether CEOs, or janitors, we’re Homo Economicus. We work to earn to live.

Earning unites us. Renaming Labor Day as Earner Day places the emphasis squarely, where it belongs, on the need to earn, not the means (laboring).

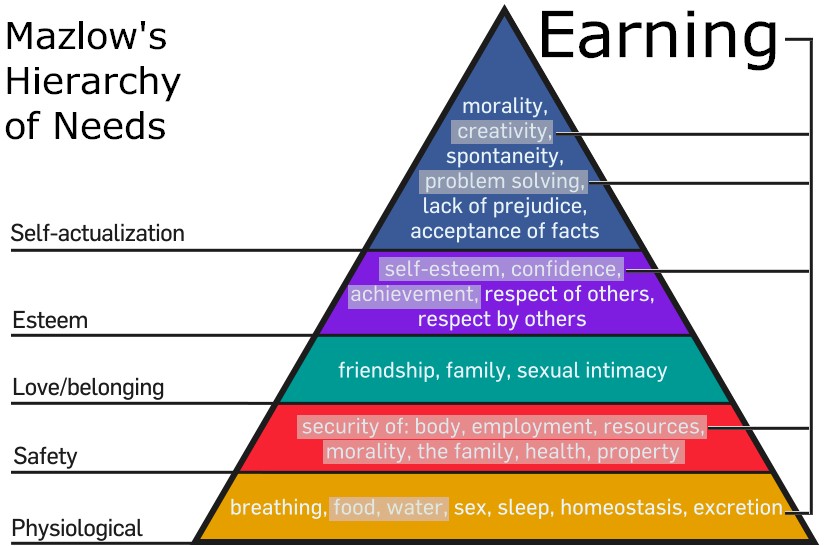

You may remember Mazlow’s hierarchy of needs from Psych 101. Mazlow studied the lives of Albert Einstein, and other greats to arrive at a hierarchy of human needs. Needs at the bottom of the triangle must be satisfied before needs at the top can be. What’s curious is to notice that about 50% of what we need derives directly from earning. It’s fundamental. One wonders how the world might change if we put one tenth as much systematic effort into distributing earning, as we now invest elsewhere. Would the need for prisons and war be reduced?

Have a happy Earner Day, and a good Earner Year!

How to get your boss to open his pay.

People have been asking us for an easy way to break the ice with their bosses about sharing a % of their pay. If your boss is like most, he may not get it right away. No worries. We’ve noticed earners get it quickly, but sometimes super earners take longer. To help him get up to speed; first, take 1 minute to sign up at right – because your boss will probably only do it if people around him are – then, hang this poster up in your cubicle, or some place where he’ll see it. If he asks, “Why would I want to do this?”, smile and say “Because it’s good to share!“, and send him to this link.

If you earn more than $325K in the US, you’re among the top 1% of earners, what we call, a super earner. As a group, super earners take home 23.5 % of all pay , up from 9% 30 years ago. Many of your fellow earners, those in the bottom 99%, think you should share some of your pay.

Openyear recommends a minimum 3% contribution of your pay (Open Pay). A portion of which will go directly to any earner who influences you, the rest will be added to Openyear revenues to provide all earners with a small % of their pay that they will use to reward other earners who influence them. Here’s why you should do it.

1. Get a social responsibility rating (like a credit rating), which makes your reputation for “walking the talk” of fair play real. This means better morale inside your business, and an easier time recruiting and keeping talent, resulting in a more competitive organization.

1. Get a social responsibility rating (like a credit rating), which makes your reputation for “walking the talk” of fair play real. This means better morale inside your business, and an easier time recruiting and keeping talent, resulting in a more competitive organization.

2. Get help with your agenda. There’s more smart people outside your company than inside your company. People are more likely to help when they know they’re guaranteed to be paid should they influence you, or any other super earner.

3. Build a faster growing economy. More money in more hands creates markets. People in the bottom 99% can better afford to buy what you’re selling.

4. Reduce violence and criminality. What’s peace of mind worth? In other countries with higher inequality than the US, the rich need bodyguards, armored cars and super secure homes.

5. Put your charitable dollars to, arguably, its most effective use, as inequality touches on so many different problems, from childhood well being and life expectancy to the strength of democracies.

Financial Analyst talks about Openyear

Video of a NYC financial analyst talking about Openyear.

How to be a billionaire? Got an MBA & MS from the "right" schools. Too bad I am not a white male with a biblical name