Class Cooperation. Not Class Warfare.

January 25, 2010 by Openyear

Filed under Super Earners

If you earn more then $325K in the US, you’re in the top 1% of all earners. You’re a super earner. Chances are you own a business, manage a business or have a great portfolio. You depend on your business. Your business depends on consumers. Consumers depend on earners.

When earning isn’t well distributed, consumers lean on credit. When credit runs out, consumers can’t buy what you’re selling. The economy stalls. This is where we are now. What’s the way back? Balance has to be restored. Goldman Sachs knows it. They’re looking for an alternative to increased taxation. That’s why they’re considering enforcing a requirement that all their executives donate 4% of their bonuses to charity. Here at Openyear, we’re asking you to consider donating 3% of your income to the bottom 99% to help reduce inequality. We call it Open Pay. Open Pay distributes pay based on relative person to person influence. With respect to reducing inequality, Open Pay is 4X more efficient than taxation. Take a look at our 5 reasons to open your pay here, or read on to learn why we think Open Pay is, arguably, the best use of your charitable dollar.

You probably think in terms of drivers. If a ship is sinking, bailing is essential, but fixing the driver, the leak, is critical. Epidemeologists have recently identified inequality, itself, as a driver of many of society’s problems – from lack of trust to violence and imprisonment.

If you have an interest in any of these problems, you can address each issue one at a time. Or, more productively, address then all in one action, by focusing squarely on inequality.

Super Earners have asked us the question, “I see how this can help the middle, but what about the poor?” Poverty can be understood as a system. Its 2 most important drivers are growth and inequality. The size of the pie, as measured by GDP, gets lots of attention. But what about it’s counterpart – how the pie gets sliced – as measured by the Gini Index – it gets far less attention. But, it’s the elephant in the room.

Your charitable contribution to Open Pay goes directly to earners in the bottom 99%. 90% of all earners in the US make less than $100K. This $100K and under earner group gives, on average, 2.2% of their income to charity, as compared to 1.8% for super earners. Since 10%+ of what they give goes towards the basic needs of the poorest, as compared to about 5% for super earners,

Open Pay, enables you to strengthen the middle, and that helps cascade giving to the poor. Consider that people in the middle probably know more poor people than you do, and leverage their domain expertise. Class cooperation. Not class warfare.

You value your time. You value your effectiveness. We challenge you to consider what other single action you can take that helps to improve both society and markets at the same time. Why wait for higher taxation, when you can demonstrate leadership now on an alternative approach to ameliorating inequality, that puts money directly into people’s pockets based on merit ? Please consider Open Pay today, your staff and the public will love you for it!

Move Your Money

|

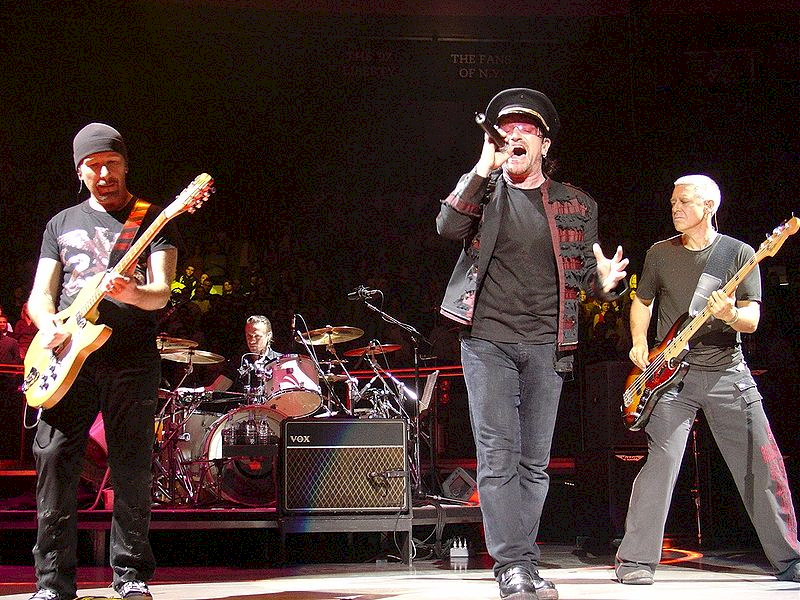

U2’s front man, Bono, points to People Power and the Upside-Down Pyramid as one of the big ideas that’s going to make the next 10 years more interesting. He says, “Increasingly, the masses are sitting at the top, and their weight, via cellphones, the Web and the civil society and democracy these technologies can promote, is being felt by those who have traditionally held power.” Or, as the band has paraphrased lyrically, from their song Silver and Gold, |

Captains and Kings in the ship’s hold

They came to collect

Silver and gold, silver and gold.

I seen the coming and the going

Seen the captains and the Kings.

Seen their navy blue uniforms

Seen them bright and shiny things, bright and shiny things.

The temperature is rising

The fever white hot

Mister I ain’t got nothing

But it’s more than you’ve got

These chains no longer bind me

Nor the shackles at my feet

Outside are the prisoners

Inside the free (set them free).

A prize fighter in a corner is told

Hit where it hurts – For Silver and Gold

You can stop the world from turning around

You just gotta pay a penny in the pound.

We don’t know if blogger Arianna Huffington, film maker Eugene Jarecki, and financier Robert Johnson were listening to Silver and Gold when they hatched their plan for the Move Your Money movement, but they’ve given life to the lyric.

Frustrated with the lack of financial reform of the banking system, and the lack of remorse from the big bankers that brought on the Great Recession, they’re encouraging people in the US to vote with their dollars, and move their money from large banks to community banks to better support their communities. Whether in a large bank or small bank, your money is equally safe because FDIC insures all accounts up to $250K. But, still, you may be wondering, “why should I bother”?

The official Move Your Money video below uses the 1946 film, “It’s a Wonderful Life” to explain why moving your money matters. It’ also happens to be one of our favorite films, so much so, that we ‘ve used it in our Open Pay video (at right).

To the reasons already offered to make the move, we’d like to offer a couple of our own. First, if you’re credit worthy and can’t get a mortgage, car or business loan, you may want to think of access to credit as a pright – a right provisioned as a product.

Your community bank likely makes most of its money on straight forward loans that they, themselves, hold, not on opaque derivatives trading, as many large banks do. So, your small act(s) of moving dollars to them, helps provision a pright to credit within your community more reliably than voting for a candidate who promises the same.

Second, think about what bankers in your community earn, relative to bankers at large banks. Chances are it’s a number considerably closer to what you earn yourself. Your small act(s) strengthens their position and reduces inequality – shown to weaken the economy overall and is the source of many social problems.

If, like us, you’re looking for the Big Plus over the next 10 years, rather than a repeat of the Big Zero (no job creation – no home appreciation -no stock market gains) that we’ve had over the last 10, ask your self this question, “Is my purchase, support or other economic acts going to send money upwards or pull it down?” Moving your money to a community bank is a great way to pull it down. It keeps your money circulating where you live – to better benefit your family, friends and neighbors.

If you want more info, you can watch Robert Johnson explain on Democracy Now how Move Your Money got going. And, remember, the economy exists to serve U 2. It’s not just the GDP, it’s the Gini. Or, in other words, it’s not just the size of the pie that counts, it’s also how the pie gets sliced which keeps us all well!